Welcome Taxtotech Readers!

In today’s digital world, paperwork is becoming a thing of the past—and so are physical signatures. Whether you’re filing taxes, applying for tenders, or submitting legal documents, Digital Signature Certificates (DSC) are the new norm. At Taxtotech, we believe in simplifying complex tech for you. So, if you’ve ever wondered what exactly is a DSC and why everyone’s talking about it, you’re in the right place!

Let’s decode everything you need to know about DSCs—what they are, how they work, why you might need one, and how they’re legally recognized in India.

📌 What is a Digital Signature Certificate (DSC)?

A Digital Signature Certificate (DSC) is an electronic form of a physical signature, used to authenticate documents, emails, or online transactions securely. It acts as a secure digital key issued by certifying authorities (CAs) in India.

Think of it as your digital identity—when you digitally sign a document using DSC, you’re verifying that you are who you say you are.

🧾 Why are DSCs Important in India?

For taxtotech Readers dealing with:

- Income Tax Filing

- MCA (Ministry of Corporate Affairs)

- DGFT (Import-Export)

- EPFO

- E-Tendering Portals

A DSC is often mandatory. The Indian IT Act, 2000 gives digital signatures the same legal status as handwritten signatures.

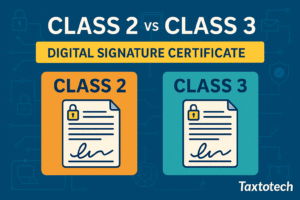

🔐 Types of Digital Signature Certificates

Digital Signature Certificates are broadly categorized into three types. Here’s a breakdown for easy understanding:

📊 Table 1: Types of DSC and Their Uses

| DSC Type | Purpose | Users | Validity |

|---|---|---|---|

| Class 1 | Email verification | Individuals | Rarely used now |

| Class 2 | Filing ROC, IT Returns | Company Directors, Professionals | 1–3 years |

| Class 3 | E-tenders, E-auctions | Vendors, Government Contractors | 1–3 years |

⚠️ Note: As of 2021, Class 2 and Class 3 have been merged for most uses. Still, the name continues in common use.

🏛️ Legal Validity of DSC in India

Under the Information Technology Act, 2000, digital signatures are:

- Legally equivalent to physical signatures

- Admissible in courts

- Valid for signing contracts, financial documents, and legal forms

Taxtotech Tip: Never share your DSC USB token or password—it’s your personal legal instrument.

👥 Who Needs a DSC?

You may need a DSC if you fall into any of these categories:

📊 Table 2: Mandatory DSC Use Cases in India

| Category | Purpose | Portal/Platform |

|---|---|---|

| Directors & CA/CS | MCA e-filing | MCA Portal |

| Taxpayers | Income Tax returns (Audit cases) | Income Tax Portal |

| Exporters | DGFT filings | DGFT Portal |

| Bidders & Vendors | E-tender participation | GEM, NIC portals |

| EPF/ESIC Employers | Compliance Filing | EPFO, ESIC Portals |

✅ If you run a business or are involved in any regulatory compliance, you likely need a DSC.

🛠️ How Does a Digital Signature Work?

A DSC uses asymmetric encryption. It has two keys:

- Private Key (kept with you securely)

- Public Key (shared to verify your signature)

When you sign a document digitally:

- Your DSC encrypts the data using your private key.

- The recipient verifies it using your public key.

- If the keys match, the signature is valid and untampered.

💵 How Much Does a DSC Cost?

The cost depends on the type, validity period, and provider. Prices range from ₹500 to ₹2000. Most common is the Class 3 DSC with 2 years validity.

You can get a DSC from authorized Certifying Authorities such as:

- eMudhra

- Capricorn

- Sify

- NSDL

- VSign

Taxtotech Tip: Always buy from a licensed CA. Compare prices and renewal terms before purchasing.

📝 Documents Required to Apply for a DSC

To apply for a DSC, you’ll need:

- Passport-size photograph

- PAN Card

- Aadhaar Card (with mobile linked)

- Email ID & Mobile Number

- Video KYC (for online verification)

🌐 Where Can I Get a DSC?

Visit trusted providers or apply online through:

- eMudhra

- Capricorn CA

- Taxtotech Guides — (for step-by-step support)

🧑💻 How to Use a DSC?

Once issued, the DSC is stored in a USB Token (cryptographic device). Plug it into your PC/laptop and:

- Register on relevant government portals

- Use compatible software (Java, DSC utility)

- Sign PDF documents using Adobe Reader or government utility tools

🔄 Validity & Renewal of DSC

- Validity: 1 or 2 years (rarely 3 years)

- Renewal: Begin renewal at least 15 days before expiry

- No need for fresh documents if data is unchanged

🔍 How to Verify if Your DSC is Active?

- Open your DSC utility (from CA provider)

- Plug in your USB token

- Click on “View Certificate”

- Ensure it’s not expired and is issued to your correct PAN

✅ Final Words for Taxtotech Readers

In a world rapidly moving online, Digital Signature Certificates (DSC) are no longer optional—they’re essential. For secure, authenticated, and legally valid online interactions, DSCs are your go-to solution. At Taxtotech, we strive to make these transitions smoother for Taxtotech Readers by offering in-depth, jargon-free content you can trust.

❓ Frequently Asked Questions (FAQs)

Q1. Is DSC legally valid in India?

Yes, under the IT Act, 2000, it holds the same weight as physical signatures.

Q2. Can individuals apply for DSC?

Yes. Even individuals can apply if they file taxes, handle contracts, or need to sign digital documents.

Q3. How long is a DSC valid?

Most certificates are valid for 1 or 2 years, after which they must be renewed.

Q4. Is video KYC mandatory for DSC?

Yes, video verification is now a standard step in online DSC issuance to comply with security norms.

Q5. Can I use one DSC on multiple portals?

Yes, a single Class 3 DSC can often be used across multiple portals like MCA, IT, GST, and DGFT.

💬 Let’s Hear From You!

Was this article helpful? If you still have questions, drop them in the comments below. 👉 Share this with your colleagues or check out more insightful blogs at Taxtotech.