Why the UK State Pension Matters More Than Ever in 2025

With the cost of living rising and retirement stretching longer than ever before, the UK State Pension has become a financial lifeline for millions. In 2025, the full new State Pension stands at £221.20 per week, or about £11,502 per year. But here’s the catch—not everyone qualifies for the full amount. The good news? You can legally and effectively boost your pension income by filling gaps in your National Insurance (NI) record.

This guide will explain:

- What NI gaps are

- How they affect your pension

- Steps to check and fill these gaps

- Whether topping up is worth it

What Is the UK State Pension?

The UK State Pension is a government-funded retirement income provided to individuals who have reached State Pension age and paid or been credited with enough National Insurance (NI) contributions.

👉 As of 2025:

- State Pension age: 66 (rising to 67 by 2028)

- Full new State Pension: £221.20/week

- Minimum qualifying years: 10

- Full pension qualifying years: 35

Understanding National Insurance Contributions (NICs)

You earn a year of National Insurance credits when you:

- Work and earn over £242/week (2025 threshold)

- Receive benefits like Universal Credit or Carer’s Allowance

- Claim Child Benefit (especially for stay-at-home parents)

If you have less than 35 qualifying years, your State Pension is reduced proportionally.

What Are NI Gaps and Why Do They Matter?

An NI gap is a year where you didn’t earn enough, claim benefits, or receive credits. These gaps lower your pension amount.

🔍 Example:

If you’ve worked for 30 years instead of 35, you’ll get: 30 ÷ 35 × £221.20 = £189.26/week That’s a £1,659 annual loss!

How to Check for NI Gaps (Step-by-Step)

- Visit GOV.UK Go to: https://www.gov.uk/check-national-insurance-record

- Log in with your Government Gateway ID

- Review each year See whether it’s marked as:

- Full year (✓)

- Partial year (⚠️)

- Gaps present (✖)

- Explore how to make it up You’ll be guided on whether you can:

- Pay voluntary contributions (Class 3)

- Get NI credits (retrospective claim)

Voluntary Contributions: Should You Top Up?

If you find gaps, you may be able to buy extra years for a one-time fee.

💰 Cost vs Benefit:

- 1 year of Class 3 NI: ~£824.20 (2025 rate)

- Adds ~£5.67/week to your pension

- That’s an extra £294/year for life

⚖️ Break-even point: You’ll recover your investment in about 3 years. After that, it’s pure gain.

Who Should Consider Paying for NI Gaps?

✅ People aged 45–65 with gaps ✅ Stay-at-home parents who missed claiming Child Benefit ✅ Self-employed who missed Class 2 NI ✅ Expats returning to the UK

🛑 Avoid if:

- You’re unlikely to reach 10 qualifying years

- You already qualify for the full pension

- You have serious health concerns affecting life expectancy

Extra Tip: Carer’s and Child Benefit Credits

You might qualify for free NI credits if:

- You were caring for a child under 12 and claimed Child Benefit

- You were a full-time unpaid carer for someone disabled

You can apply to backdate these if missed: ➡️ Apply for National Insurance credits

Additional Ways to Boost Retirement Income

- Delay your State Pension

- Increase ~5.8% per year you defer

- Great for healthy retirees

- Workplace Pension

- Contribute more into your employer’s scheme

- Benefit from tax relief + employer match

- Personal Pension (SIPP)

- Ideal for the self-employed

- Flexible investment options

Quick Reference Table: NI Gaps & Top-Up Options

| Factor | Details (2025) |

|---|---|

| Full new State Pension | £221.20/week |

| Required NI years for full | 35 |

| Class 3 voluntary NI cost | ~£824/year |

| Gain per year added | £294/year (lifetime) |

| Break-even time | ~3 years |

| Last chance to pay for gaps | Up to 6 years back (until April 2025) |

| Credits for carers/parents | Free – must claim separately |

FAQs About Maximising UK State Pension

Q1: Can I still fill NI gaps after retirement age? ✅ Yes, as long as it’s within 6 tax years prior. Some older gaps may still be eligible under temporary rules.

Q2: Will I get pension automatically? ❌ No, you must claim it when you reach State Pension age. You’ll get a letter 4 months before.

Q3: How often is State Pension paid? Every 4 weeks, directly into your bank account.

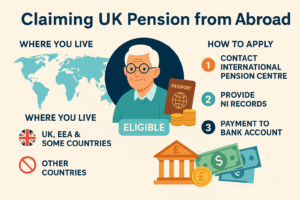

Q4: Can I get pension while living abroad? ✅ Yes, but annual increases (triple lock) only apply if you live in certain countries (like EEA, USA, not Australia).

Conclusion: Act Early, Retire Securely

Understanding and managing your National Insurance record is one of the smartest retirement strategies available. A few hours spent today reviewing your record could mean thousands of extra pounds across your retirement.

Whether you’re in your 40s or just a few years from retiring, it’s never too late to take control of your State Pension.