Why State Pension Age Is More Than Just a Number

Knowing your State Pension age is essential to planning your retirement. It dictates when you can begin receiving your State Pension payments, and impacts everything from retirement budgeting to workplace exit strategy.

Over the years, the UK government has changed pension age multiple times to reflect longer life expectancy, economic sustainability, and gender equality. This article breaks down:

- How to calculate your exact pension age

- Why pension age is changing

- What future reforms might mean for you

1. What Is the UK State Pension Age?

The State Pension age is the age at which you become eligible to start receiving State Pension payments from the UK government.

🔹 As of July 2025:

- For both men and women: 66 years

- Scheduled increase to 67 between 2026 and 2028

- Further rise to 68 expected between 2044 and 2046, though under review for earlier implementation

2. How to Find Your Exact Pension Age (Step-by-Step)

- Visit: https://www.gov.uk/state-pension-age

- Enter your date of birth

- View your State Pension age and eligibility date

This service will also tell you when you can claim and if future changes apply.

3. History of State Pension Age: From Gender Gap to Equality

- Before 2010:

- Women: 60

- Men: 65

- 2010–2018:

- Pension ages equalized

- 2019–2020:

- Raised to 66 for all

- 2026–2028:

- Rising to 67

- Post-2044 (or earlier):

- Proposed rise to 68

🧓🏼📈 These changes reflect a key reality: people are living longer, and pensions must stretch further.

4. Why Is the Pension Age Increasing?

- Longevity: In 1948 (when the pension was introduced), life expectancy was 68. In 2025, it’s 81.

- Economic strain: The cost of pensions has ballooned to over £110 billion per year.

- Fairness: Keeping pension age equal for men and women ensures gender parity.

5. How Do Pension Age Changes Affect You?

🧠 Scenario Example:

If you’re born 1 June 1960, your State Pension age is 66. If you’re born 1 June 1961, it’s 66 and 3 months. Born after April 1967? Pension age will likely be 67 or higher.

Always use the official calculator to check!

6. Will the State Pension Age Rise to 68 Sooner?

Yes, it’s possible.

The Cridland Review and 2023 Department for Work and Pensions (DWP) report recommended bringing the increase to 68 forward to 2037–2039, rather than 2044.

However, as of mid-2025:

📢 “The government has paused the decision to allow further review based on life expectancy trends.”

Stay alert—especially if you’re in your 40s or early 50s.

7. The WASPI Campaign: A Lesson in Pension Reform

The WASPI (Women Against State Pension Inequality) movement highlights the disruption caused by sudden changes:

- Women born in the 1950s were hit hardest

- Many had insufficient notice about delayed pension age

- An Ombudsman ruled DWP failed in communication

🧾 Key takeaway: Monitor reforms early and adapt your retirement plans accordingly.

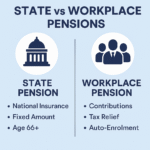

8. State Pension Age vs Private Pension Access Age

They’re not the same.

| Pension Type | Access Age |

|---|---|

| State Pension | 66 (rising to 67/68) |

| Workplace/Personal Pension | 55 (rising to 57 in 2028) |

📌 You can access private pensions earlier, giving you flexibility if you want to retire before State Pension age.

9. Planning Ahead for Your Retirement Age

Use your State Pension age as a financial benchmark, not a finish line. Here’s how:

- 📊 Estimate your retirement budget from age 55 to 90

- 🧮 Use pension calculators to fill income gaps

- 🔁 Review your State Pension forecast: https://www.gov.uk/check-state-pension

- 📈 Consider delaying your pension for a 5.8% boost per year

10. Quick Guide: State Pension Age Timeline

| Birth Year | State Pension Age |

|---|---|

| Before 6 Oct 1954 | Already receiving pension |

| 1954–1960 | 66 |

| 1961–1967 | 66–67 (gradually increases) |

| 1968–1977 (estimated) | 67+ (subject to reform) |

| Post 1978 | Likely 68+ (depending on future decisions) |

FAQs: UK State Pension Age

Q1: Can I retire before my State Pension age? Yes—but you won’t receive your State Pension until your official age. You can use private pensions or savings before that.

Q2: Can I defer my State Pension? Yes. You’ll receive extra payments for life. Deferring for 1 year increases your pension by ~5.8%.

Q3: Will everyone’s pension age rise again? Most likely, yes. Future generations (born after 1970) may face State Pension ages of 68 or even 70.

Conclusion: Know Your Age, Plan Your Future

Your State Pension age is more than a policy number—it’s the foundation of your retirement strategy. The earlier you understand and plan for it, the better your financial future will look.

🎯 Combine this with workplace pensions, personal savings, and retirement investments for a smoother journey into retirement.

Call to Action (CTA)

✔️ Use the State Pension age checker today ✔️ Sign up to our newsletter for real-time updates on UK pension reforms ✔️ Follow us on LinkedIn for retirement tips, calculators, and expert interviews