The Hidden Inequality in Retirement

You’ve heard of the gender pay gap, but have you heard of the gender pension gap?

In the UK, women retire with significantly less pension wealth than men. The gap can be as high as 35% or more, especially among those nearing retirement. While the State Pension aims to be equal, real-life factors—from career breaks to part-time work—lead to deep inequality in retirement income.

This article explores:

- The causes of the gender pension gap

- How it affects UK State and private pensions

- What steps women (and policy makers) can take to close the gap

1. What Is the Gender Pension Gap?

The gender pension gap is the percentage difference in retirement income between women and men. It reflects long-term disparities in:

- Earnings

- Work history

- Pension contributions

📊 According to the Pensions Policy Institute (PPI):

“Women aged 65 and over have on average 35% less pension income than men.”

2. Causes of the Gender Pension Gap in the UK

🔸 A. Lower Lifetime Earnings

Women often earn less due to:

- The gender pay gap

- Employment in lower-paid sectors (e.g. care, education)

- Underrepresentation in senior roles

🔸 B. Part-Time Work

Around 75% of part-time workers in the UK are women, resulting in:

- Lower pension contributions

- Missed auto-enrolment eligibility (under £10,000/year threshold)

🔸 C. Career Breaks for Childcare or Elderly Care

Maternity leave or time off for caregiving often leads to:

- Gaps in National Insurance contributions

- Missed private pension growth

- Slower salary progression

🔸 D. Divorce and Pension Splitting

Pensions are often overlooked in divorce settlements.

💬 “Only 12% of divorces include pension sharing orders.” – ONS 2024

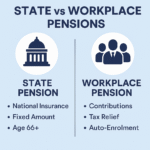

3. The Gender Gap in State Pension: Still a Problem?

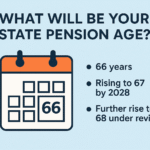

While the new State Pension system (post-2016) aims to be fairer:

- Many older women still rely on the basic State Pension, which was based on fewer qualifying years

- Home responsibilities protection (HRP) was often missed due to poor DWP record-keeping

- Even with credits, some women don’t qualify for full State Pension (£221.20 per week in 2025)

🧾 If you’ve had career gaps, check your NI record here: https://www.gov.uk/check-national-insurance-record

4. The Gap in Workplace Pensions

🔹 Defined Contribution (DC) Pensions:

- Contributions depend on earnings

- Women contribute lower amounts due to lower salaries or part-time status

🔹 Auto-Enrolment Issues:

- Employees earning under £10,000/year may not be auto-enrolled

- Many women fall into this bracket due to part-time jobs

📌 Policy Proposals:

- Remove the £10k threshold

- Reduce minimum age for auto-enrolment

- Mandate pension sharing in divorce

5. Real-Life Example: Same Age, Same Role, Different Future

👩 Emma (Age 35):

- Worked full-time from 22 to 30

- Took a 5-year career break for childcare

- Returned part-time, earning £12,000/year

- Pension contributions paused for 5 years and reduced after

👨 James (Age 35):

- Worked full-time since age 22

- Consistently contributed to pension

- Employer matched 5% annually

By age 67, James may retire with 50–70% more pension wealth than Emma—even though they had similar jobs early on.

6. Bridging the Pension Gap: What Women Can Do Today

✅ Check your State Pension forecast

Visit: https://www.gov.uk/check-state-pension

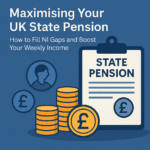

✅ Top up missing NI years

- Buy Class 3 voluntary contributions

- Prioritise years close to retirement

- Maximise your 35 qualifying years

✅ Use Child Benefit claims wisely

If not working, claiming Child Benefit ensures NI credits—even if you don’t receive payments due to the High-Income Child Benefit Charge.

✅ Ask for a pension forecast from your provider

✅ Increase workplace pension contributions, even slightly

Even 1–2% extra makes a huge compound impact over time

✅ Consider a Lifetime ISA (LISA) if under 40

- Government adds 25% bonus on contributions

- Can be used after age 60, tax-free

7. Policy Recommendations to Reduce the Gap

- Mandate pension contributions during maternity leave

- Scrap auto-enrolment thresholds to include low earners

- Pension sharing should be standard in divorce proceedings

- Provide financial education on pensions in schools and workplaces

8. Gender Pension Gap vs Gender Pay Gap (Comparison Table)

| Aspect | Gender Pay Gap | Gender Pension Gap |

|---|---|---|

| Focus | Income while working | Income in retirement |

| Visibility | Publicly discussed | Often hidden |

| Causes | Discrimination, inequality | Career breaks, low contributions |

| Scale (2024–25 avg) | ~14% | ~35% |

| Impact duration | Career phase only | Lifelong (post-retirement) |

FAQs on Gender Pension Gap

Q1. Is the gender pension gap illegal? No, it’s not a legal issue like the gender pay gap. It’s a structural financial inequality, not direct discrimination.

Q2. Can men have low pensions too? Yes. The issue is about disparity based on gender norms, not absolute wealth.

Q3. Will the new State Pension fix this for future generations? It helps, but unless workplace reforms happen (like auto-enrolment changes), the gap will persist.

Conclusion: It’s Time to Close the Pension Gap

Women deserve to retire with dignity—and equality. While systemic reforms are necessary, individual action now can still improve outcomes later.

Take control of your pension story—check, contribute, and challenge.

Call to Action (CTA)

✔️ Use the UK State Pension forecast tool ✔️ Share this post with working women in your circle ✔️ Subscribe to our newsletter for tips on closing the pension gap