Retiring Abroad? Don’t Leave Your UK Pension Behind

Planning to spend your golden years in Spain, India, or Australia? You’re not alone. Thousands of Brits and former UK workers retire overseas every year. The good news? You can still claim your UK State Pension from abroad—but only if you follow the right steps.

This guide will walk you through:

- Eligibility to receive UK pension overseas

- The claim process step-by-step

- Countries where your pension can be uprated (increased yearly)

- Taxes and bank details

- Common mistakes to avoid

Let’s secure your pension, wherever life takes you.

1. Who Can Claim UK State Pension Abroad?

You can claim your UK State Pension overseas if you:

- Have 10 or more qualifying years of National Insurance (NI) contributions

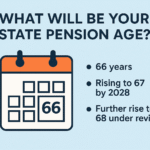

- Have reached the State Pension age (66 as of 2025)

- Live in any foreign country (there’s no residency restriction)

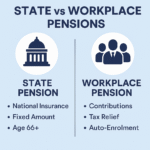

✅ You can even continue to receive private or workplace pensions abroad.

2. Will My Pension Be Increased Each Year? It Depends!

The UK only increases State Pensions annually (uprating) if you live in:

- The European Economic Area (EEA)

- Countries with a social security agreement with the UK

- Countries like the USA, Switzerland, Turkey, and the Philippines

❌ No uprating if you’re in:

- India

- Australia

- Canada

- New Zealand

- Most of Africa and Asia (unless a reciprocal deal exists)

📌 So if you move to India, your pension will stay frozen at the amount when first paid.

3. Step-by-Step: How to Claim UK Pension Abroad

✅ A. Apply 4 months before reaching State Pension Age

You cannot apply online from abroad.

Use one of these:

- Phone (International Pension Centre) 📞 +44 (0)191 218 7777 Open: Monday to Friday, 8am to 6pm (UK time)

- Post Send form IPC BR1 to: The International Pension Centre, Tyneview Park, Newcastle upon Tyne, NE98 1BA, UK

- Or ask the pension authority in your new country if they have an agreement with the UK.

✅ B. Provide the following documents:

- Your UK National Insurance number

- Date of birth and proof of ID (passport)

- Your overseas bank account details (IBAN + SWIFT code)

- Your foreign address and tax status abroad

4. Where Will My Pension Be Paid?

You can choose:

- A UK bank account

- A foreign bank account (in local currency or GBP)

💷 Note: You may lose some money on exchange rates or international bank fees.

5. UK State Pension Tax Rules for Expats

- The UK State Pension is taxable in the UK, but you may avoid double taxation

- The UK has double taxation agreements (DTAs) with over 130 countries

- Use form DT-Individual to claim tax relief if your country has a DTA with the UK

📌 Example:

If you live in Spain, you may pay tax on your UK pension in Spain, not the UK.

6. Pension Uprating: Table of Eligible Countries

| Region | Uprated Pension? | Examples |

|---|---|---|

| UK + EEA | ✅ Yes | France, Germany, Ireland, Netherlands |

| Countries w/ Deals | ✅ Yes | USA, Jamaica, Turkey, Switzerland |

| No Deal Countries | ❌ No | India, Canada, Australia, Nigeria, Pakistan |

🔎 Check official list: https://www.gov.uk/state-pension-if-you-retire-abroad

7. What About NI Contributions While Living Abroad?

If you’ve not reached 35 qualifying years, you can:

- Voluntarily pay Class 2 or Class 3 NI contributions

- Check eligibility here: https://www.gov.uk/voluntary-national-insurance-contributions

🧮 Class 3 cost (2025): £17.45/week (£907/year) 🕐 Backdating allowed up to 6 years, so you can fill past gaps too.

8. Real Example: John Moves to Spain

John is 67 and has:

- 35 qualifying years of NI

- No private pension

- Plans to retire in Spain

✅ His pension is fully payable and uprated yearly 🏦 Paid into his Spanish bank account in Euros 💼 He doesn’t pay UK tax, as Spain taxes him under the DTA agreement

9. Common Mistakes to Avoid

🚫 Don’t assume your pension is automatic abroad—you MUST apply 🚫 Don’t rely on online tools—they don’t support overseas applications 🚫 Don’t forget to update your foreign address and bank info

📩 Notify changes via: https://www.gov.uk/international-pension-centre

10. UK Pension Abroad FAQs

Q1. Can I get my full pension abroad? Yes, if you qualify and claim it properly. Location only affects uprating, not amount.

Q2. Can I still pay into UK pensions if I live overseas? Yes, if you’re eligible, you can pay voluntary NI contributions.

Q3. Do I lose my pension if I move abroad? No. The UK State Pension is portable, but uprating and tax may change.

Conclusion: Enjoy Retirement, No Matter Where You Are

Your UK pension doesn’t stop at the border—but the rules are different overseas. Make sure you understand:

- Where to claim

- What your payment rights are

- Tax implications

- How to keep your pension growing if possible