The July 31st deadline has passed. The initial rush is over, and now the dust is settling. In this period, taxpayers generally fall into two camps: those who missed the deadline entirely, and those who filed in a hurry and now suspect they might have made a mistake. If you’re in either of these situations, the question is: what now? This is where taxpayers often get tangled in the confusion between two important options: filing a Belated ITR vs Revised ITR.

Don’t worry, Taxtotech Readers. These two types of returns serve very different purposes, and choosing the right one is crucial to staying compliant and minimizing financial penalties. They are your second chance to get things right with the Income Tax Department.

At Taxtotech, we believe in empowering you with absolute clarity. This guide will break down the precise differences, deadlines, and consequences of each, so you can make the correct and most beneficial choice for your situation.

What is a Belated ITR? For Those Who Missed the Deadline

A Belated Income Tax Return, as the name suggests, is a return that is filed after the original due date has passed. For most individual taxpayers, the original due date is July 31st. So, any return filed from August 1st onwards is considered a belated return.

This option is provided under Section 139(4) of the Income Tax Act, giving taxpayers a window to file their ITR even if they missed the initial deadline.

Key Features and Consequences of a Belated ITR

While it’s a relief to know you can still file, a belated return comes with certain consequences:

- Final Deadline: You can file a belated return for the Financial Year 2024-25 (Assessment Year 2025-26) until December 31, 2025.

- Mandatory Penalty: You will have to pay a late filing fee under Section 234F.

- ₹5,000 if your total income is more than ₹5 lakh.

- ₹1,000 if your total income is up to ₹5 lakh.

- Interest on Tax Due: If you have any outstanding tax liability, you will be charged interest at 1% per month under Section 234A from the original due date (August 1st) until the date you file.

- Loss of Carry-Forward Benefits: This is a major drawback. If you file a belated return, you cannot carry forward certain losses (like business losses or capital losses) to offset against future income. However, you can still carry forward losses from house property.

What is a Revised ITR? For Correcting Mistakes

A Revised Income Tax Return is used to correct any mistake, omission, or wrong statement made in your original tax return. This could be anything from forgetting to claim a deduction, reporting incorrect income, entering wrong bank details, or a simple personal information error.

This facility is provided under Section 139(5) of the Income Tax Act. The key condition is that you must have filed your original ITR before the initial due date (July 31st).

Key Features and Benefits of a Revised ITR

Revising your return is a penalty-free way to correct your tax records.

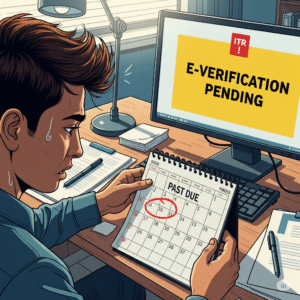

- Final Deadline: Just like a belated return, the deadline to file a revised return for FY 2024-25 is December 31, 2025.

- No Penalty: There is absolutely no penalty for filing a revised return. It is your right as a taxpayer to correct genuine mistakes.

- Unlimited Revisions: You can revise your return multiple times before the deadline. The last one submitted will be considered the final one.

- Can You Revise a Belated ITR? Yes! This is a crucial point. If you filed a belated return and then found a mistake in it, you are still allowed to revise it before the December 31st deadline.

Belated ITR vs. Revised ITR: The Head-to-Head Comparison

To eliminate any confusion, here is a direct comparison of the two. This table will help you identify which return applies to your situation instantly.

| Basis of Comparison | Belated ITR (under Section 139(4)) | Revised ITR (under Section 139(5)) |

|---|---|---|

| Primary Purpose | To file your ITR for the first time, after the original due date. | To correct a mistake in an already filed original ITR. |

| Who Should File? | Someone who did not file their ITR by July 31. | Someone who filed their ITR by July 31 but needs to make a correction. |

| Governing Section | Section 139(4) of the Income Tax Act. | Section 139(5) of the Income Tax Act. |

| Final Deadline | December 31, 2025 | December 31, 2025 |

| Applicable Penalty | Yes. A late filing fee under Sec 234F is mandatory. | No. There is no penalty for revising your return. |

| Interest on Tax Due | Yes. Charged under Sec 234A from the original due date. | Applicable only if the revision results in a higher tax liability. |

| Can Losses be Carried Forward? | No (except for house property loss). | Yes, all eligible losses can be carried forward. |

A Brief Note on ITR-U: The Updated Return

There is a third type of return, the ITR-U (Updated Return), which serves a different purpose. It allows you to update your return by declaring additional income you previously missed.

| Scenario | Best Option | Reason |

|---|---|---|

| You found a mistake and want to claim a higher refund. | Revised ITR | ITR-U cannot be used to claim a refund or increase a refund. |

| You forgot to declare some income (e.g., interest, freelance income). | ITR-U (or Revised ITR if within the deadline) | ITR-U is specifically for declaring income you missed, but it comes with an additional tax penalty. |

| The deadline for Belated/Revised ITR (Dec 31) has passed. | ITR-U | ITR-U can be filed within 24 months from the end of the relevant assessment year, giving you a much longer window. |

Filing Made Simple and Accurate with Taxtotech

Mistakes happen, especially when you’re rushing to meet a deadline. But using the right support system can prevent these errors from happening in the first place. Taxtotech’s intelligent tax filing platform has built-in checks and expert assistance to ensure your original return is filed accurately, eliminating the need for revisions.

And if you do find yourself needing to file a Belated or Revised ITR, our experts can guide you through the process seamlessly. We help you understand the implications, calculate any applicable fees or interest, and file correctly to ensure you stay compliant. Don’t navigate the post-deadline confusion alone. Visit https://taxtotech.com to get the expert help you need.

Conclusion: Choose Wisely, File Promptly

The choice between a Belated ITR vs Revised ITR is simple once you understand their purpose. To put it plainly: a Belated ITR is for those who didn’t file on time, while a Revised ITR is for those who filed on time but made a mistake.

For Taxtotech Readers, the key takeaway is to act promptly. The final deadline of December 31, 2025, is absolute. Addressing your filing status now will save you from further complications and give you peace of mind.

Call to Action:

Have you ever had to file a belated or revised return? What was your experience? Share your tips or questions in the comments below to help others in our community!

Frequently Asked Questions (FAQs)

Q1: How many times can I revise my ITR? A: You can revise your income tax return as many times as you need to before the deadline of December 31, 2025. The last return submitted will be considered the final and correct one by the Income Tax Department.

Q2: What is the penalty if I don’t file even a belated ITR by December 31st? A: If you fail to file even a belated ITR, the Income Tax Department may initiate penalty proceedings, which can be up to 50% of the tax you would have paid, in addition to the tax and interest due. It can also lead to prosecution in more serious cases.

Q3: I filed a belated return. Can I revise it later if I find another mistake? A: Yes. A belated return can be revised, just like an original return, as long as you do it before the December 31st deadline.

Q4: If I file a revised ITR and am due a bigger refund, will I get it? A: Yes. If your revision corrects an error that results in a higher tax refund, the Income Tax Department will process the revised return and issue the additional refund amount to you.

Q5: Do I need to pay the late filing fee before submitting my belated ITR? A: Yes. You must first pay the applicable late filing fee (under Sec 234F) and any tax due along with interest. You need to provide the challan details of this payment in your belated ITR form before you can submit it.