Understanding how much UK State Pension you’re entitled to can be confusing, especially with changing rules and contributions. Whether you’re close to retirement or planning ahead, this guide breaks down how the full UK State Pension is calculated, what factors lead to reduced payments, and how to forecast your pension income.

💷 1. The Full UK State Pension in 2025

As of the 2025–2026 tax year:

| Type | Weekly Amount | Annual Amount |

|---|---|---|

| New State Pension (Post-2016) | £221.20 | £11,502.40 |

| Basic State Pension (Pre-2016) | £169.50 | £8,814.00 |

- You qualify for the full New State Pension if you have 35 qualifying years of National Insurance (NI) contributions.

- Partial pensions are given with minimum 10 qualifying years.

🔍 Tip: Use the UK Government’s State Pension Forecast tool to see your personalized estimate.

📊 2. Factors That Affect How Much You’ll Receive

Several key factors impact your final weekly or annual pension amount:

✅ National Insurance Contributions

- Each qualifying year boosts your pension.

- Gaps can reduce your entitlement unless you voluntarily top up (Class 3 contributions).

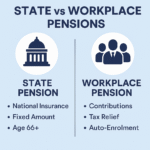

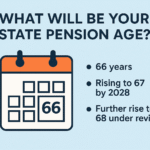

📅 When You Reached State Pension Age

- If you reached pension age before 6 April 2016, you fall under the Basic State Pension scheme.

- After this date, you are under the New State Pension rules.

🌍 Living Abroad

- You can still receive your UK pension, but index-linked increases (annual inflation adjustments) are only given in certain countries.

🧮 3. How to Calculate Your State Pension Forecast

Here’s a general idea based on your NI years under the New State Pension:

| NI Qualifying Years | Estimated Weekly Pension |

|---|---|

| 10 years (minimum) | £63.20 |

| 20 years | £126.80 |

| 35 years (full) | £221.20 |

🎯 Formula: £221.20 ÷ 35 × Your qualifying years

🧾 4. What If You Have a Pension Shortfall?

You can:

- Buy voluntary NI contributions to fill historical gaps

- Delay your pension claim to increase weekly payments

- Combine with private or workplace pensions for a higher income

⚠️ 5. Reduced UK Pension: Common Causes

| Cause | Result |

|---|---|

| Gaps in NI due to unemployment, self-employment without NI, or moving abroad | Reduced pension |

| Contracting out (pre-2016) | Deduction in pension |

| Less than 10 years of NI | No state pension |

🛡️ 6. Pension Credit: For Those Who Get Less

If your income is below a certain level, Pension Credit can top it up.

- Guarantee Credit: Ensures a minimum weekly income

- Savings Credit: For those who have modest savings or workplace pensions

Apply via: www.gov.uk/pension-credit

📌 Summary Table

| Topic | Details |

|---|---|

| Full State Pension (2025) | £221.20/week if 35 years NI |

| Minimum to qualify | 10 years |

| Calculation Formula | £221.20 ÷ 35 × years of NI |

| Voluntary Contributions | Class 3 allowed |

| Pension Credit | Available for low income pensioners |

💡 Conclusion

The UK State Pension is a vital part of your retirement plan, but it’s not automatic or guaranteed at the full amount. Understanding your entitlement and taking steps to close gaps early can significantly improve your financial comfort in retirement.